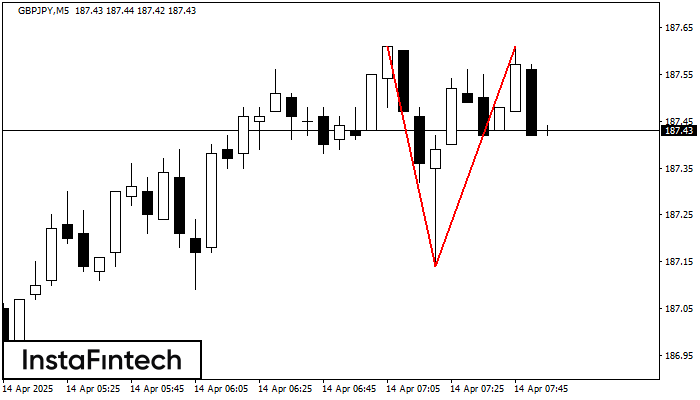

was formed on 14.04 at 06:55:39 (UTC+0)

signal strength 1 of 5

signal strength 1 of 5

The Double Top reversal pattern has been formed on GBPJPY M5. Characteristics: the upper boundary 187.61; the lower boundary 187.14; the width of the pattern is 47 points. Sell trades are better to be opened below the lower boundary 187.14 with a possible movements towards the 186.99 level.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength