Analysis of Trades and Trading Tips for the British Pound

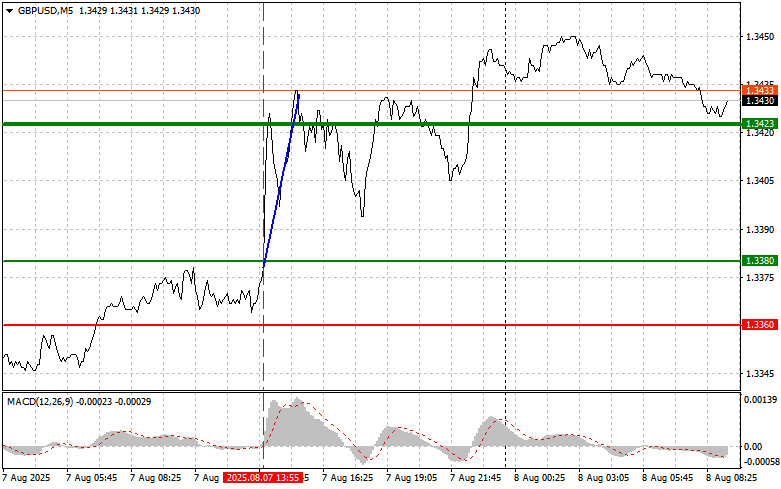

The test of the 1.3380 level occurred when the MACD indicator had just started moving upward from the zero line, confirming a valid entry point to buy the pound. This resulted in a rise of more than 40 pips.

Yesterday's decision by the Bank of England to cut interest rates to a two-year low — as predicted by most analysts — provided significant support to the GBP/USD currency pair. Despite the rate cut, the BoE Governor emphasized that there was no need for further large-scale economic stimulus measures. The market interpreted this as a signal that no additional rate cuts should be expected in the near future.

Yesterday's announcement that Donald Trump had appointed Steven Miran — seen as more loyal to him — to replace Adriana Kugler on the Federal Reserve Board put even more pressure on the dollar. Investors perceived this as a factor that could accelerate the pace of rate cuts in the United States. Miran's appointment sparked widespread discussion about potential political influence on the Fed and the threat to the central bank's independence.

Today, the only notable event will be a speech by BoE Monetary Policy Committee member Huw Pill. However, given recent comments from Andrew Bailey, no fundamentally new information is expected. The current strengthening trend of the British pound will likely continue, as market participants keep analyzing the BoE's decision and its potential impact on the UK economy.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3440 (green line on the chart), aiming for growth toward 1.3484 (thicker green line on the chart). Around 1.3484, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 pip pullback. A continued rise in the pound can be expected as part of the ongoing bullish trend.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3418 level while the MACD is in the oversold area. This will limit the pair's downside potential and trigger a reversal upward. A rise toward the opposite levels of 1.3440 and 1.3484 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after a breakout below 1.3418 (red line on the chart), which could lead to a rapid decline in the pair. The sellers' key target will be 1.3381, where I intend to exit shorts and immediately open long positions in the opposite direction, targeting a 20–25 pip rebound. Selling the pound today is only advisable as part of a minor correction.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3440 level while the MACD is in the overbought area. This will limit the pair's upward potential and trigger a downward reversal. A decline toward the opposite levels of 1.3418 and 1.3381 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.